We talk regularly about people in their 50's or older having their hand forced into retiring earlier than planned due to something at work like a layoff or something with their health. Doing a quick Google search, Gemini gave three different numbers via different studies at 58%, 46% and 40%. Dialing in a precise number isn't so important as realizing the number is big which makes preparing for that outcome pretty important.

Axios had a long read about AI taking jobs with the title including White Collar Bloodbath. Again, who knows about bloodbaths but AI is either a threat to jobs or for some people it can be a tool to help them perform more effectively and efficiently. Instead of rationalizing why your livelihood isn't threatened, I would suggest trying to figure out how it is threatened and then try to figure out how to adapt. There is no reason to get caught completely off guard by this. Hopefully it works out the way you want but odds of it working out the way we want are better by making the effort to stay current and adapt.

Maybe at 60 or 65 you have enough money to retire if your hand is forced and that is your plan. That's probably valid but as a personal bias of mine, how financially resilient are you in case of something going wrong that is very expensive to fix?

This from Yahoo has a couple of bad stories and plenty of grim numbers about medical expenses and lack of adequate coverage. If there is a path to a better healthcare system (here I mean the system, not the quality of care which is a whole other issue), I don't know what it is. This is why I go on ad nauseum about getting on the right side of the insulin resistance/insulin sensitivity spectrum and the importance of retaining the ability to bend down and pick up heavy things (like free weights).

The more you can do to avoid the doctors' office and medications, the easier every other aspect of life will be. At 59, I am long past the age where things can start to go wrong. I've been lifting weights since junior high (that's right, I said junior high) and got much more dialed in on diet eight years ago. One thing that is abundantly clear is there there is no such thing as being too old to lift weights. There might be exercises that should be done with substitutes (deadlifting for example versus one of the many substitutes for actual deadlifting).

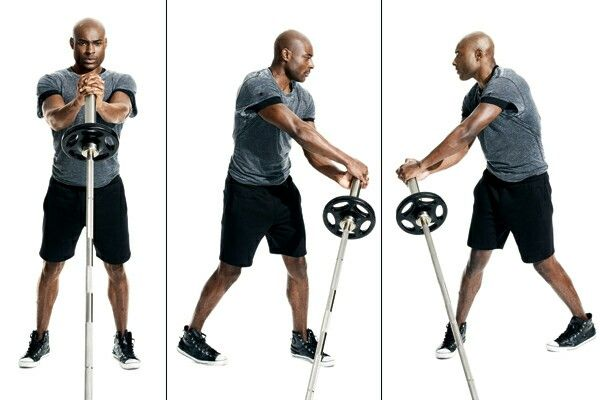

This morning I went down to the firehouse to do a mini, off day workout and ended up working in a little bit with another firefighter who is ten years older than me. He is able to packtest (timed, weighted hike to qualify as a wildland firefighter) and it's pretty clear his commitment to stay in shape is why. My mini workout consisted of jump rope, landmine rotations (I go down much further than the picture) and then without stopping, a set of landmine squats with a shoulder press at the top of each squat. At the end, I worked in with my buddy on the bench. This mini workout was partly about lifting weights but also about sucking wind, weightlifting with the right intensity is also a cardiovascular workout.

You are not too old to do something weights even if you have to invest time to figure out the right workout for yourself. Quick note, the so called landmine exercises are new to me. The rotation exercise is great for your trunk and the odds of injury seem to be very low. Landmine squats are much safer than barbell back squats. There are quite a few other landmine exercises to go learn about.

If your hand is forced into retirement but you're able to either avoid medical issues or even just push them off into the distant future, it can still be very challenging to starting withdrawing from your retirement assets, this can be true of any age. Barron's lists out several potential behaviors here. The article seems to focus on guilt which doesn't resonate with me. It makes the case and some of the comments validate the guilt response but the one that resonated more was a subset of of "inherited money scripts" related to not being able to cover some sort of medical catastrophe if we needed to.

Everyone has their own idea about saving money, spending and so on but regardless of anyone's beliefs on saving and spending, money is optionality and money is a safety net. I think beliefs related to saving and spending come down to how we value optionality and having a safety net. It is also important to know ourselves well enough to know whether we might have any sort of hang up about taking money out. Like I said, my thing is having enough to pay for a horribly expensive medical thing. I am far less concerned about dying with too much unspent money. It's totally valid to view it the other way.

The last link to hit on is another one from Barron's about people not knowing what to make of the future of Social Security and essentially panicking into taking earlier than they planned. I am far from believing/saying everyone should wait or everyone should take it early but I do believe that at some age everyone should start to figure out when they think they should take it. Early, late, right at full retirement age, whatever, have some idea early and then revisit the belief and your numbers to dial in more precisely. There's a lot of nuance to claiming strategies though that make getting it wrong a high probability for people who don't invest the time to make informed decisions.

Probably worse than making a mistake, is panicking into taking it earlier than planned. I am sympathetic to the concern that "strategic uncertainty" could spillover into Social Security but that is not where we are now. A reader left a comment citing Diane Swonk as saying so many boomers are now taking it early that it is moving the needle on government spending. As I replied, the rational assessment is that no one now over the age of maybe 50 or 55 will have to deal with a cut to Social Security and while I do believe that, I would suggest running your numbers a second time assuming there will be a cut or means testing or something else.

The recurring theme in this post and many other posts over the years is trying to prevent or solve our own problems. Trying to get out in front of how AI will impact your work, figuring out what you'd do if you could no longer work, staying fit and investing time to learn about Social Security's nuances are all part of solving our own problems. Having a terrible diet of breakfast cereal and soda is an unforced error. Not understanding how Social Security works is an unforced error. Avoiding these mistakes will improve the odds for a better outcome.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment